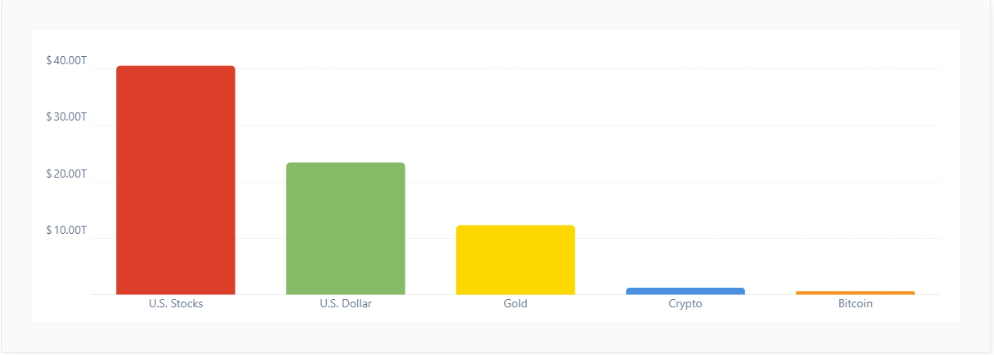

The gold-backed cryptocurrency market experienced significant growth in 2023, attracting investors seeking stability and cryptocurrency players looking to invest in the $12 trillion gold market.

In this article, we’ll take a quick look at the best options for becoming a gold-backed cryptocurrency in recent years. Before we examine these gold-backed digital assets in detail, let’s take a look at what it means to be backed by a gold-backed cryptocurrency

What is gold backing for cryptocurrencies?

Gold-backed cryptocurrencies are digital tokens backed by visual gold reserves. These cryptocurrencies combine the features of traditional gold bitcoins with the benefits of blockchain technology. Each token represents a certain amount of gold, usually in simple terms of weight (e.g. ounces) or grams.

Gold-backed digital currencies are a type of stablecoin because they feature a link to the value of gold. In this sense, gold-based cryptocurrencies are similar to default-backed stablecoins, such as Tether (USDT) and USD Coin (USDC) ), in that they enable investors to benefit from blockchain design while enjoying the stability and low volatility of real-world assets.

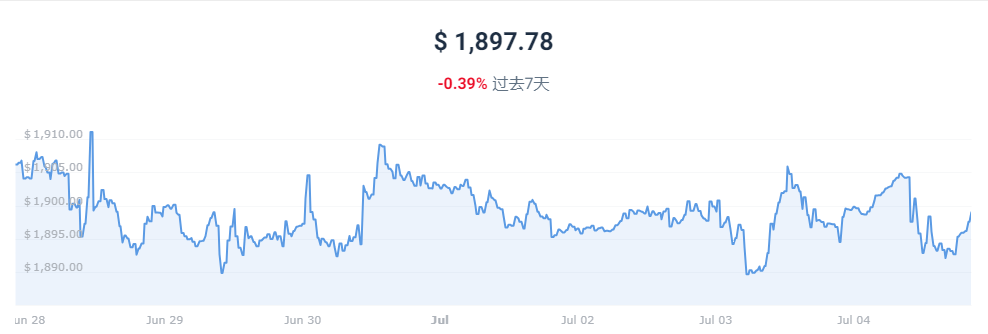

Gold has risen 5.4% this year and is currently trading at $1,922. Over the past five years, the asset has grown by more than 53%, similar to the rise in the U.S. stock market index S&P 500 over the same period, which recently rose 61% over the same period. In the following section, we will examine the best gold backing for cryptocurrencies.

PAXG

PAX Gold is an ERC-20 token that is fully collateralized by One Gold Hengan Gold.PAX Gold is built on the Ether blockchain, providing investors with easy access and seamless transferability. The paper was eventually written At the time, PAXG was the largest gold-backed digital asset in the cryptocurrency market, with a market capitalization of $482 million.

The token complies with the regulatory framework (license from the New York Department of Financial Services), ensuring a trustworthy and secure investment experience. Contrary to other gold-based investment vehicles, PAXG does not charge custodian fees, has an instant settlement time, and can be immediately exchanged for physical gold.

XAUT

Tether Gold is a product of the popular stablecoin company Tether and is popular among cryptocurrency investors. As of this writing, Tether Gold is the second largest gold-backed currency by market capitalization.

Each XAUT token represents one troy ounce of gold held in a Swiss vault. According to Tether, there are currently 611 gold bars, totaling more than 7.6 tons, stored in the vault.XAUT offers gold investors enhanced divisibility (tokens can be divided into increments as small as 0.000001 troy ounces of gold) and easy storage options (no need to take care of physical gold).

GFC

GoldCoin is an ERC-20 gold-backed cryptocurrency on the Ether network. Through GFCs, investors have access to a decentralized gold-backed asset that can be purchased in fiat or cryptocurrency. Each GFC is backed by 1/1000 ounce of gold stored in a vault.

GoldCoin positions itself as an affordable alternative and private alternative to owning gold in digital form. No proof of identity is required to purchase GFCs and investors do not need to submit any documents to access the gold market.

KAU

Kinesis Gold is a cryptocurrency project backed by physical precious metals.There are two such tokens on the Kinesis platform: the Kinesis Gold (backed by gold) and the Kinesis Silver (backed by silver). Both tokens utilize the interoperability of Stellar blockchain technology and can be transmitted on the Kinesis blockchain network.

Kinesis has over 150,000 users globally and manages over $200 million in assets under management (AUM). Silver and physical bullion are stored in secure vaults, allowing users to keep their savings safe in less volatile assets. Each KAU token represents 1 gram of gold.

Cryptocurrency-Backed Cryptocurrencies Allow Easy Access to Gold Exposure Cryptocurrencies backed by gold allow investors to gain exposure to the precious metal without the high transaction and storage fees usually associated with buying and storing gold.

At the end of the day, there’s a lot that’s actually left out – specific opportunities, specific decisions – things that often don’t materialize in a single article.