文章目录[隐藏]

- Yesterday we analyzed 10 “potential stocks”, today continue to share another 10, you can pay attention to, this article does not serve as investment advice, only as knowledge sharing.

- 11. Scroll

- 12. Polygon 2.0

- 13. Starknet

- 14. EigenLayer

- 15. Thena Finance

- 16. Lybra Finance

- 17. LayerZero

- 18. Ethos Reserve

- 19. Conic Finance

- 20. Level Finance

Cryptocurrencies Focus on 11-20

Yesterday we analyzed 10 “potential stocks”, today continue to share another 10, you can pay attention to, this article does not serve as investment advice, only as knowledge sharing.

11. Scroll

Scroll positions itself as the zk Rollup L 2 network with the most complete ethereum spirit, and in addition to being well-funded (Polychain, Sequoia China, OKX, etc.), the development team has the technical know-how to support this position.

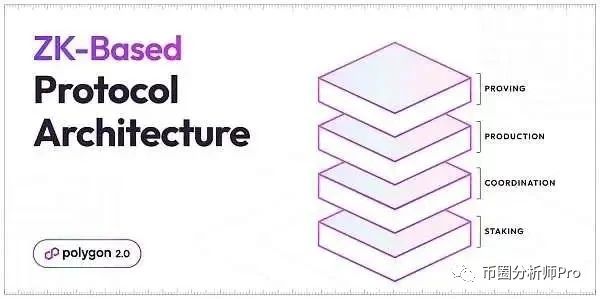

12. Polygon 2.0

With Optimism’s introduction of the OP Stack, other leading L 2s such as Arbitrum, zkSync, and others are making similar attempts at modular extensions. This includes the Polygon development team’s recently proposed Polygon 2.0 upgrade, which aims to become a Supernet “combining many L 2s” in which any user can create, exchange, and program value, and in which any developer can create L 2 networks without a license.

13. Starknet

Starknet is an ethereum zk Rollup L 2 network. not classified as a zkEVM due to its use of the programming language Cairo, Starknet is designed to generate STARK proofs that reduce the time spent verifying transactions while maintaining the security of the main ethereum network, resulting in low transaction fees and high throughput. The improved version, Cairo 2.0, is expected to dramatically increase transaction speeds in the long run, helping dApps such as DeFi, gaming, social, and others push the boundaries of what is possible.

14. EigenLayer

EigenLayer is a game-changing enough protocol to be the first to present the ‘repledge’ narrative.EigenLayer is a value layer that most dApps, RAAS (Rollups-as-a-Service), L 1, and L 2 can utilize EigenLayer as their economic structure.

15. Thena Finance

Thena is a DEX built on the BSC network and is one of the highest yielding protocols for token holders in the entire BSC ecosystem. Thena still has a lot of potential if CoinShares supports (or lists) this BSC-native project, or if Thena goes multi-chain.

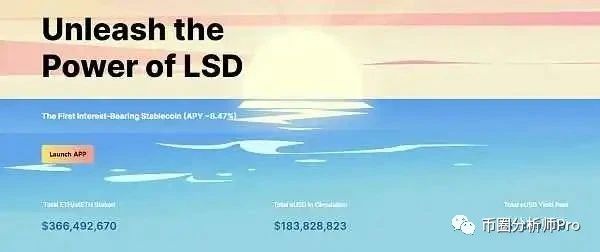

16. Lybra Finance

Lybra Finance, one of the best LSDFi projects, is a stablecoin protocol backed by LSD. Its selling point is that users mint the auto-interest-bearing stablecoin eUSD by depositing ETH or stETH, and holders get a real-time return of about 7.2% on APY.

“Give you a stablecoin and it will multiply in your wallet if you hold on to it”.

17. LayerZero

Arguably, LayerZero is one of the best innovations in the crypto industry today and is backed by top-tier venture capitalists including a 16 z and Sequoia.

LayerZero is a cross-chain infrastructure (not a cross-chain bridge), which can help users and developers to realize the information transfer between different blockchain networks, and also realize the information transfer between dApps in different networks, and realize the whole-chain dApps. e.g. The data and asset interaction information of DeFi apps on chain A can be transferred to the DeFi apps on chain B.

At present, LayerZero supports information transfer between EVM chains such as Ether, Avalanche, Fantom, Arbitrum, Optimism and non-EVM chains such as Aptos.

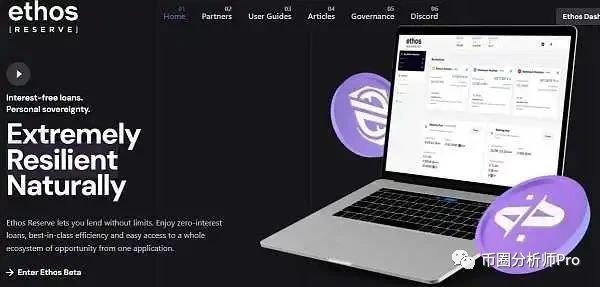

18. Ethos Reserve

Ethos Reserve is an efficient and stable lending protocol built on the Optimism network, with a high LTV (Loan-to-Value), accepting a wide range of collateral types and offering interest-free credit. Currently users can earn ERNs for depositing assets ETH, BTC, OP.

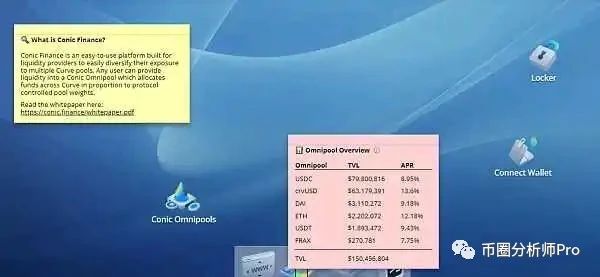

19. Conic Finance

Conic Finance is a platform built for liquidity providers to easily diversify their investments across multiple Curve pools. Any user can provide liquidity to the Conic Omnipool, which allocates funds across Curves proportionally based on agreed pool weights.

Omnipool’s TVL is currently over $150 million and has the potential to grow to $500 million.

20. Level Finance

Level Finance is a perpetual DEX originally built on the BSC network and later expanded to the Arbitrum network.

Recently the development team came up with a token destruction proposal to regulate token emissions, and so far 180,000 LVL tokens have been burned.

This is why I am bullish on Level Finance for the long term. At the time of writing, Level Finance has incurred a massive $516,000 in fees over the last 24 hours, 30% of which goes to the treasury, or $154,000, which will destroy $154,000 worth of LVL tokens.

— THE END —

For the German version click here